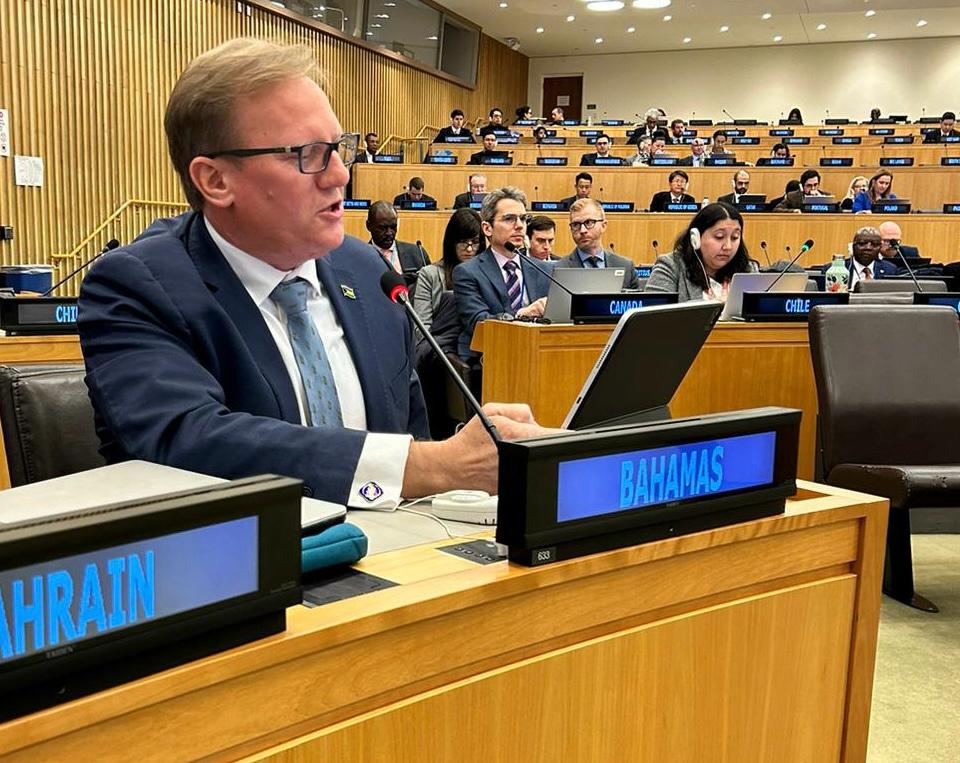

Ad Hoc Committee to Draft Terms of Reference for a United Nations Framework Convention on International Tax Cooperation

Senator The Honourable L. Ryan Pinder K.C.

Attorney General and Minister of Legal Affairs on Tuesday, 20th February, 2024

Mr. Chair,

The Bahamas wishes to congratulate you on assuming the role as Chair, and Claudia Vargas on assuming the role of rapporteur and I assure you of The Bahamas’ support throughout this process.

The Bahamas wishes to thank the African Group for the substance and advocacy that led to the adoption of General Assembly Resolution 78/230 which ultimately has led to our convening this monumental initiative today.

Mr. Chair,

For over six decades, the international tax policies as formulated and dictated by the OECD neglected or failed to address the inherent challenges and the differences in development dynamics faced by the Global South. Developing countries like The Bahamas have grappled with the disequilibrium of the international financial architecture, coupled with inconsistent, biased, and contradictory tax policies, which have stifled development and growth, and undermined the integrity of principles of international humanitarian law with respect to the right to development.

The Bahamas – reliant on Tourism and Financial Services– stands vulnerable to external economic shocks and the pernicious impacts of the climate crisis. The dichotomy between the Global North-designed international financial architecture and the imperatives for sustainable, resilient prosperity in the Global South is starkly evident in international tax initiatives. Moreover, the arbitrary blacklisting of vulnerable countries compounds their plight, perpetuating a cycle of economic disenfranchisement. We view backlisting initiatives as contrary to our right to development.

Mr. Chair,

The Bahamas has long been a leading voice for the creation of a United Nations Tax Convention. It is our view that this Ad Hoc Intergovernmental Committee offers a form of renewed multilateralism, predicated on an integrated approach and equitable representation, which is imperative to addressing the systemic inequities plaguing global governance, particularly the current international tax order.

The Bahamas is optimistic that this committee will create equity and development capacity where it did not exist before while ensuring the development of early protocols to combat tax-related illicit financial flows.

Mr. Chair,

It is clear that if we are to achieve the Sustainable Development Goals, we must have the political will to build systems that are inclusive, diverse, and equitable. The Bahamas looks forward to playing an integral role in this important process. Our aim is to achieve the development of robust draft terms of reference for a United Nations framework convention on international tax cooperation that adequately addresses the inherent constraints and development approaches of the Global South and Small Island Developing States like The Bahamas.

Thank you.